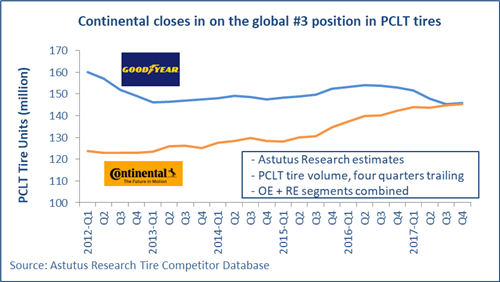

New analysis from Astutus Research suggests that Continental Tire is closing in on the global number three position in the PCLT tire sector, and is set to move ahead of Goodyear in the rankings.

The phrase “Big 3” is still used to describe the tire industry triad of Bridgestone, Michelin and Goodyear. In the passenger car and light truck (PCLT) tire sector, however, Continental Tire is now clearly a peer of this group. Furthermore, Astutus Research believes that it is set to push Goodyear into fourth place.

Goodyear as a whole remains larger than Continental Tire as it sells substantially more truck tires and is one of the leaders in large-OTR tires and aircraft tires. However the $90bn PCLT tire sector is the key battleground for the largest players in the global tire market.

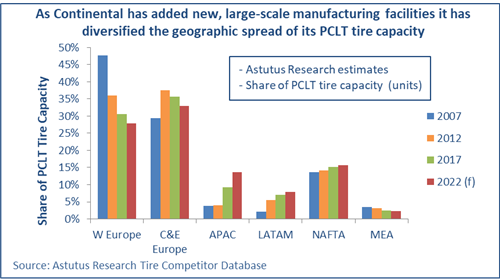

Continental successfully restructured its Western European tire operations and turned around its North American tire business through the 2000s. The company closed high cost plants and significantly expanded capacity in lower cost countries. At the same time it moved to eliminate less profitable sales, withdrawing from the US private label tires business and being more selective over original equipment fitments. The company also disposed of the majority of its specialty tire operations, leaving it less diversified than many of its large rivals. This enabled it to focus its research & development spending, capital expenditure and management attention on its PCLT tire and truck tire businesses.

Continental now has a strong, highly cost competitive PCLT tire businesses. Benchmarking from Astutus Research highlights its successful manufacturing strategy that compares favourably with its rivals and has been fundamental to the company’s robust performance, including:

scale – an efficient footprint of PCLT tire plants, with a high average capacity;

location – a large share of PCLT tire capacity is located in lower cost regions;

utilisation - and a consistently high plant utilisation rate.

As a result, Continental Tire has been able to profitably expand its business and gain market share. In 2011, Goodyear sold over 40 million more PCLT tires than Continental; by 2016 the differential had fallen to less than 11 million tires. By the end of 2017 the companies were essentially level pegging.

Furthermore, over the next few years we expect Continental Tire to add PCLT tire capacity at a significantly faster pace than Goodyear. Given Continental’s track record for achieving high plant utilisation from capacity additions this should flow through to increased sales volumes, moving the company into third position behind Bridgestone and Michelin.

At Goodyear, the reduction in volumes has in part been strategic, as it has also moved to reduce sales of less profitable tires and focus on higher margin large-rim-diameter tires. On the supply-side, the company has eliminated some capacity that was high-cost or focused on non-premium segments. We believe, however, that scope for further rationalization remains, particularly in Europe. The key challenge now for Goodyear is to return to sustained volume growth whilst continuing to streamline its portfolio.

Having taken a leadership position in the Western and Central European market, Continental Tire is ramping up output at its modern PCLT Tire plants in Russia (Kaluga), the US (Sumter) and Brazil (Camaçari). This should enable it to increase its market share in Eastern Europe, North America and Latin America. Meanwhile in Asia, the company has committed to a fourth round of expansion at its large plant in China (Hefei) and is building a new plant in Thailand that should allow it to develop its presence in the growing ASEAN markets.

In an increasingly competitive tire market Continental’s continued expansion will add to the pressure on mid-tier players that are less efficient and do not hold a competitive advantage through either branding or distribution.

Continental Corporation has announced that a review of its organisational structure is underway. A separation of the Rubber Group, which includes the tire business, is one possible outcome. As the tire business accounts for just one quarter of its parent’s revenues, it has perhaps come under less scrutiny than many of its peers. A stock market listing of a stand-alone tire business would, however, result in a closer inspection of its performance and outlook, and could find hidden value.

About Astutus Research

Based in London, Astutus is an independent research company focused on the global tire and automotive aftermarket sectors. We help our clients to better understand their market, their customers and their competitors.

Astutus Research tracks the size and segmentation of tire markets accounting for over 95% of global demand. We analyse the performance of all the leading tire manufacturers and our competitive benchmarking covers over 90% of the PCLT tire market by value.

For further details about our research please email info@astutusresearch.com.